The Benefits of Using a Cloud Payroll System

Hey there, are you tired of manually inputting payroll data and spending hours calculating employee salaries? It’s time to consider switching to a cloud payroll system. Not only does it make the payroll process more efficient and accurate, but it also offers a range of benefits that can streamline your business operations. From automatic tax calculations to easy access anywhere, anytime, a cloud payroll system can revolutionize the way you manage payroll. Say goodbye to paperwork and hello to convenience!

What is a Cloud Payroll System?

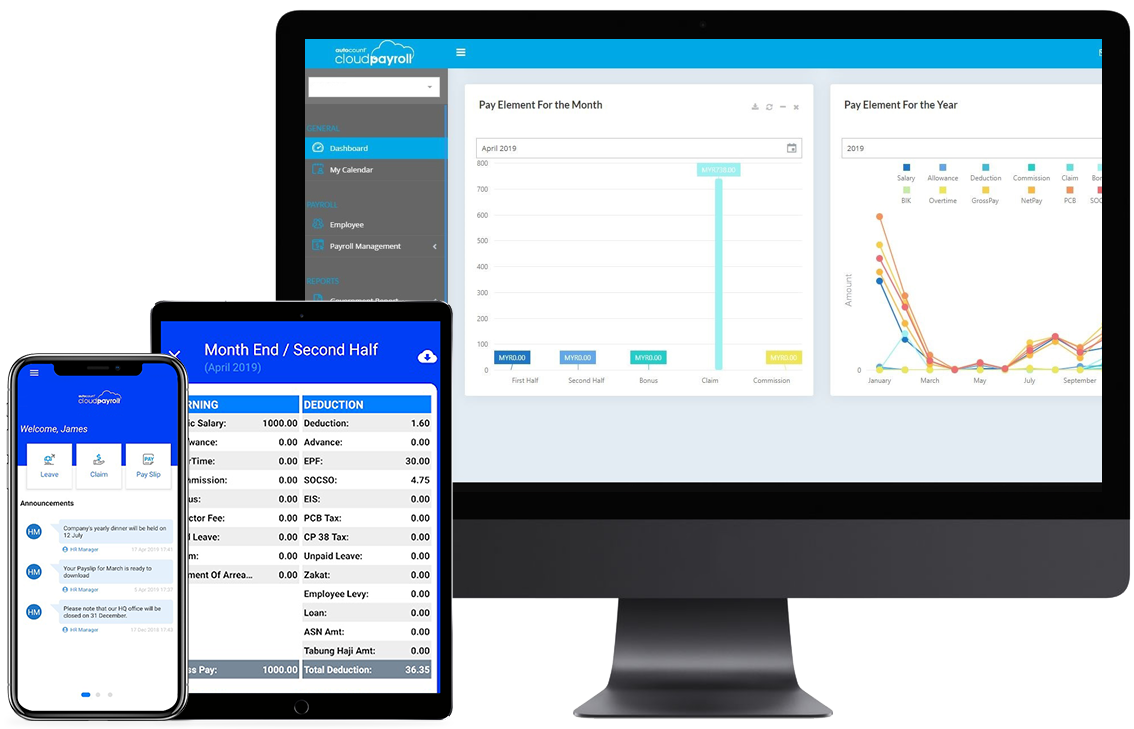

A Cloud Payroll System is a modern and innovative way for businesses to manage their payroll processes online. Instead of storing payroll information on local servers or using traditional payroll software, a cloud payroll system allows businesses to access and process their payroll data through the internet. This means that all payroll-related tasks can be done from anywhere, at any time, as long as there is an internet connection available.

With a cloud payroll system, businesses can store employee information, track hours worked, calculate wages, and process payroll taxes all in one centralized online platform. This eliminates the need for manual data entry and reduces the risk of errors that can occur with traditional, paper-based payroll systems. Additionally, cloud payroll systems often offer automated features such as direct deposit, tax filing, and customizable reporting options, making the payroll process more efficient and streamlined.

One of the key benefits of a cloud payroll system is the scalability it offers to businesses of all sizes. Whether you are a small startup or a large corporation, a cloud payroll system can easily adapt to your needs as your business grows. Most cloud payroll systems also offer a pay-as-you-go pricing model, which means you only pay for the features and services you need, making it a cost-effective solution for businesses of any size.

Another advantage of using a cloud payroll system is the enhanced security it provides for your payroll data. Cloud payroll systems often come with robust security measures such as encryption, multi-factor authentication, and regular data backups to ensure that your sensitive payroll information remains safe and protected from cyber threats.

Overall, a cloud payroll system is a convenient, efficient, and secure solution for businesses looking to modernize and streamline their payroll processes. By moving your payroll operations to the cloud, you can save time, reduce errors, and focus on other aspects of your business that matter most.

Benefits of Implementing a Cloud Payroll System

Implementing a cloud payroll system can bring numerous benefits to your organization. Cloud payroll systems offer convenience and flexibility, allowing you to access your payroll data anytime, anywhere. This means that you can process payroll from the comfort of your home or office, without being tied to a specific location. Additionally, cloud payroll systems are designed to be user-friendly, making it easy for even non-technical employees to navigate and use the system effectively.

One major benefit of implementing a cloud payroll system is the cost savings that come with it. Traditional payroll systems require a significant investment in hardware and software, as well as ongoing maintenance costs. With a cloud payroll system, all you need is a reliable internet connection and a subscription to the service. This eliminates the need for expensive hardware and software upgrades, saving your organization money in the long run.

Furthermore, cloud payroll systems provide enhanced security for your sensitive payroll data. Data breaches and cyberattacks are becoming increasingly common in today’s digital world, making it crucial to protect your organization’s payroll information. Cloud payroll systems offer advanced security features such as encryption, multi-factor authentication, and regular data backups to ensure that your data is safe and secure at all times.

Another advantage of cloud payroll systems is the scalability they offer. As your organization grows, your payroll requirements may also increase. Cloud payroll systems can easily scale up to accommodate more employees, additional features, and increased data storage capacity. This means that you can expand your payroll system without the need for costly upgrades or additional resources.

Additionally, cloud payroll systems can streamline your payroll processes and improve overall efficiency. Automation features such as automatic tax calculations, direct deposit capabilities, and customizable reporting tools can help you save time and reduce errors in your payroll operations. By automating repetitive tasks, you can free up time for your HR and payroll staff to focus on more strategic initiatives that drive your organization’s success.

In conclusion, implementing a cloud payroll system can offer a wide range of benefits to your organization. From cost savings and enhanced security to scalability and efficiency improvements, a cloud payroll system can help streamline your payroll processes and drive operational excellence. Consider making the transition to a cloud payroll system to stay ahead of the curve and take your payroll operations to the next level.

Key Features of a Cloud Payroll System

Managing payroll can be a time-consuming task for businesses, but with the evolution of technology, cloud payroll systems have become a popular solution. These systems offer a range of features that can streamline the payroll process, saving time and reducing the risk of errors. Here are some key features of a cloud payroll system:

1. Automated Payroll Processing

One of the most significant advantages of a cloud payroll system is its ability to automate payroll processing. With traditional payroll systems, manual data entry is required for every pay period, which can be prone to human error. However, with a cloud payroll system, all employee information is stored in a centralized database, and payroll calculations are automated based on this data. This not only saves time but also ensures accuracy in the payroll process.

2. Employee Self-Service Portal

Another essential feature of a cloud payroll system is the employee self-service portal. This portal allows employees to access their pay stubs, tax forms, and other payroll-related information online. Employees can also make changes to their direct deposit information, update their personal details, and even submit time off requests through the self-service portal. This feature not only empowers employees by giving them control over their payroll information but also reduces the burden on HR staff by eliminating manual requests and inquiries.

3. Real-Time Data Analytics

A robust cloud payroll system also provides real-time data analytics capabilities. This feature allows businesses to track and analyze payroll data instantly, providing valuable insights into labor costs, employee productivity, and budgeting. With real-time data analytics, businesses can make informed decisions about staffing levels, overtime expenses, and compensation structures. They can also identify trends and patterns in payroll data, enabling them to optimize their payroll processes and improve overall financial management.

Furthermore, real-time data analytics can help businesses stay compliant with tax regulations and labor laws by providing accurate and up-to-date information. By having access to real-time payroll data, businesses can quickly respond to any compliance issues and take proactive measures to avoid penalties and fines.

In conclusion, a cloud payroll system offers a range of key features that can benefit businesses of all sizes. From automated payroll processing to real-time data analytics, these systems provide efficient and accurate payroll management solutions that can save time, reduce errors, and improve overall financial management.

How to Choose the Right Cloud Payroll System for Your Business

Choosing the right cloud payroll system for your business is an important decision that can have a significant impact on your company’s operations. With so many options available in the market, it can be overwhelming to know which system is the best fit for your specific needs. Here are some key factors to consider when choosing a cloud payroll system:

1. Assess Your Needs: Before you start looking at different cloud payroll systems, take the time to assess your business needs and objectives. Consider factors such as the size of your company, the number of employees you have, your budget, and any specific payroll requirements you may have. This will help you narrow down your options and focus on systems that are tailored to your business.

2. Look for User-Friendly Features: A user-friendly interface and easy navigation are essential features of a good cloud payroll system. Look for systems that offer intuitive dashboards, customizable features, and a mobile-friendly interface. This will make it easier for you and your employees to use the system effectively without requiring extensive training.

3. Ensure Compliance: Compliance with local tax laws and regulations is crucial when it comes to payroll processing. Make sure the cloud payroll system you choose is up-to-date with the latest tax regulations and has built-in compliance features. This will help you avoid costly penalties and ensure accurate payroll processing for your employees.

4. Scalability and Integration: When choosing a cloud payroll system, it’s important to consider the scalability of the system and its ability to integrate with other software applications. As your business grows, you may need to add more employees or expand into new markets. A scalable system will be able to accommodate these changes without requiring a complete overhaul of your payroll processes. Additionally, look for a system that integrates seamlessly with other HR and accounting software you may already be using. This will help streamline your business operations and improve overall efficiency.

5. Data Security: Data security is a top priority when it comes to payroll processing. Look for cloud payroll systems that offer advanced security features such as encryption, multi-factor authentication, and regular data backups. This will help protect sensitive employee information and prevent any unauthorized access to your payroll data.

6. Customer Support: Finally, consider the level of customer support offered by the cloud payroll system provider. Look for a provider that offers 24/7 customer support, online resources, and training materials to help you make the most of your system. A responsive support team can help troubleshoot any issues quickly and ensure smooth payroll processing for your business.

By taking these factors into consideration, you can choose the right cloud payroll system that meets the specific needs of your business and helps streamline your payroll processes effectively.

Security and Compliance Considerations for Cloud Payroll Systems

When implementing a cloud payroll system, it is crucial to prioritize security and compliance to protect sensitive employee data and ensure that payroll processes adhere to regulations. Here are five key considerations to keep in mind:

1. Data Encryption: Data encryption is essential for safeguarding payroll information stored in the cloud. Make sure that the payroll system you choose utilizes strong encryption protocols to protect data both in transit and at rest. This will help prevent unauthorized access to sensitive information.

2. Access Control: Implement robust access control measures to restrict access to payroll data to authorized personnel only. Utilize role-based permissions to ensure that employees can only view and modify data that is relevant to their specific job responsibilities. Regularly review and update access rights to prevent potential security breaches.

3. Regular Security Audits: Conduct regular security audits of your cloud payroll system to identify potential vulnerabilities and weaknesses. Work with a reputable third-party auditor to assess the effectiveness of your security measures and address any gaps that may exist. This will help you stay ahead of security threats and mitigate risks proactively.

4. Compliance with Regulations: Ensure that your cloud payroll system is compliant with relevant regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Payroll data contains sensitive personal information, so it is crucial to adhere to data protection laws to avoid potential legal consequences.

5. Secure Backup and Disaster Recovery: In addition to protecting data from external threats, it is important to have secure backup and disaster recovery measures in place. Choose a cloud payroll system that offers regular backups of your data and a comprehensive disaster recovery plan in case of system failures or cyberattacks. This will help ensure that you can quickly recover and restore payroll information in the event of a data loss incident.

By prioritizing security and compliance considerations when implementing a cloud payroll system, you can protect sensitive employee data, prevent security breaches, and ensure that your payroll processes meet regulatory requirements. Investing in robust security measures and staying proactive in monitoring and reviewing your system’s security posture will help safeguard your payroll operations and maintain trust with your employees.

Originally posted 2025-05-14 17:26:05.